A Closer Look at the Distribution Used to Set the Threshold for Bona Fide EAP Employees

The NPRM claims the new salary threshold for the EAP exemption “will, in combination with the standard duties test, better define and delimit which employees are employed in a bona fide EAP capacity in a one-test system.” However, the new salary threshold is set at the 35th percentile of the non-hourly pay distribution in the South region, which is $1,059 per week. The non-hourly pay distribution includes many blue-collar workers and white-collar workers explicitly excluded from the FLSA (such as teachers), raising doubts as to whether an arbitrary threshold from this distribution has any ability to determine which EAP employees are bona fide.

The proposed threshold is substantially higher than “what the methodology used in 2004 and 2019 would produce using current data.” According to the NPRM, this substantial increase is to ensure that “lower-paid white-collar employees who perform significant amounts of nonexempt work” are required to be nonexempt.

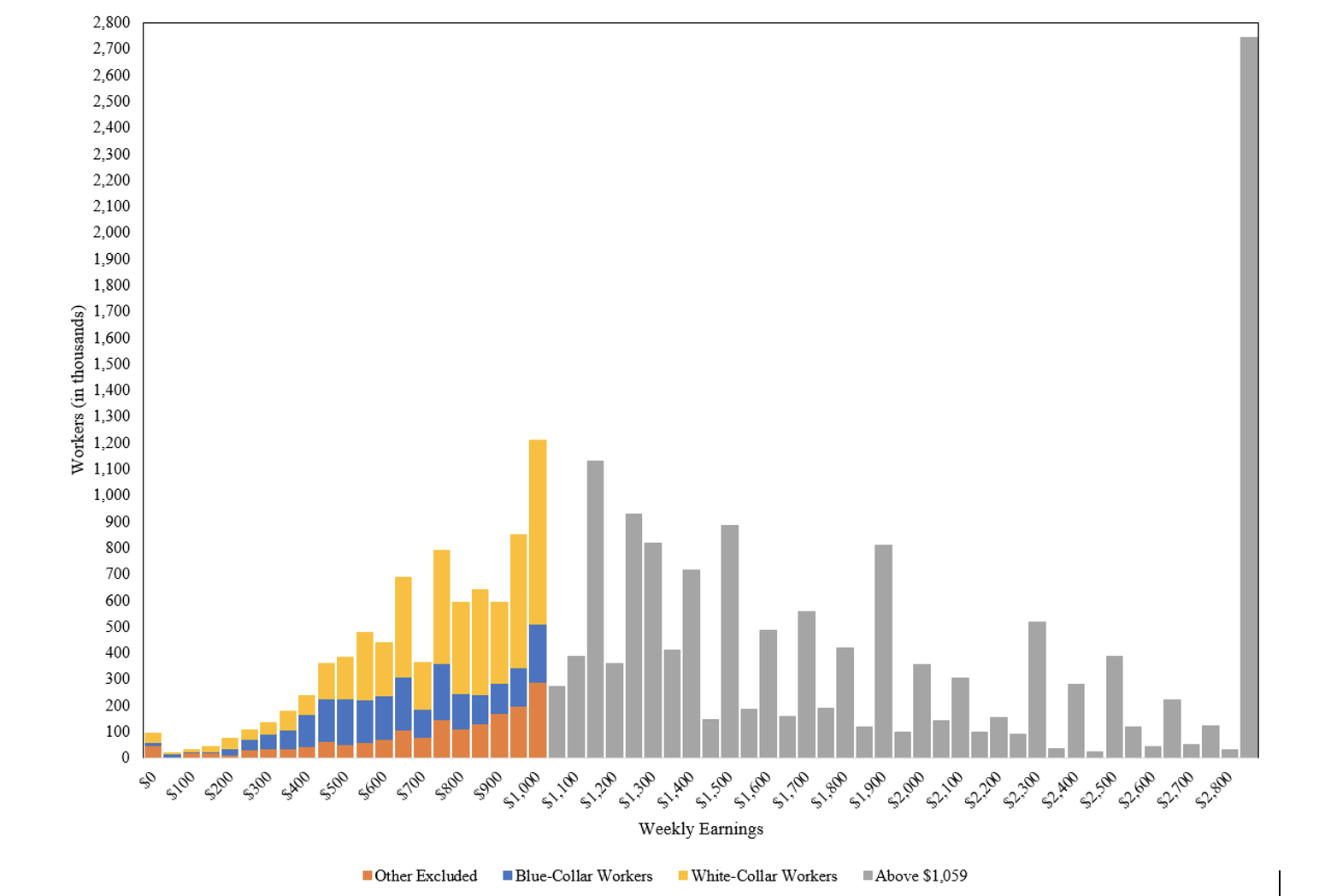

According to the data relied upon by the NPRM, and displayed in the figure below, 27% of the non-hourly employees who earn less than the proposed salary threshold are blue-collar workers (represented in the chart below by the blue section of each bar), and another 21% are in white-collar jobs, such as teachers, that are specifically excluded from the FLSA (shown as the orange section of each bar). Only 52% of employees earning less than the threshold are in white-collar jobs covered by the FLSA (shown as the gold section of each bar).

The percentage of white-collar workers covered by the FLSA included in the pay distribution used to set the threshold will decline over time because of the proposed automatic updating mechanism. In three years, when the first such update is applied, most non-hourly employees earning less than the threshold will be in either blue-collar jobs or white-collar jobs for which the FLSA is irrelevant. Over time, the proposed method for setting the salary threshold will rely increasingly on the pay distribution of blue-collar workers and white-collar workers not covered by the FLSA. This means that, in effect, whether a white-collar employee is eligible for the exemption will be based on whether they earn more than an arbitrary percentage of non-hourly workers including many blue-collar workers and white-collar workers not covered by the FLSA.

Experts

- Partner

- Partner