Important Implications of the DOL’s Proposed Automatic Updating Mechanism

Introduction

The Department of Labor’s (DOL’s) September 8, 2023 Notice of Proposed Rule Making (NPRM) increases the standard salary level for the white-collar exemption to the 35th percentile of the pay distribution of full-time, non-hourly workers in the South Census region and imposes automatic updates to the salary threshold every three years. The automatic adjustments would use the most recent quarterly data from the Current Population Survey to determine the 35th percentile of the pay distribution for full-time non-hourly workers in the South Census region.

The DOL asserts that automatic updates to the salary threshold levels are necessary “to ensure that they remain effective in helping differentiate between exempt and nonexempt employees”[1] because the salary test “becomes obsolete as wages for nonexempt workers increase over time.”[2] However, the mechanism the DOL proposes for automatically updating the standard salary level will result in increases to the salary level above and beyond those related to wage growth Even if there is no wage inflation, the DOL’s methodology would likely result in a 9.1% increase in the salary threshold over the next three years if employees assumed to be impacted by the NPRM are reclassified as hourly.[3]

DOL’s Estimate of Affected Employees

To demonstrate this and estimate the impact of the NPRM, we start with the DOL’s own assumptions regarding the number of affected employees. The DOL estimates that 3.4 million US workers will be impacted by the proposed rule, or about 6% of all employees not paid by the hour.[4] The DOL assumes that only employees who earn between $684 (the current threshold) and $1,059 (the preliminary proposed threshold) and who would pass the duties test will be impacted by the NPRM. After excluding employees not subject to the FLSA, employees who are blue-collar, paid hourly, or eligible for a different overtime exemption, and employees in a named occupation (teachers, etc.), 43.8 million workers would potentially be affected by the NPRM out of a total workforce of 166.2 million.

To determine the subset of the 43.8 million potentially affected workers that the DOL assumes will be affected, the DOL applies probabilities that a given individual will pass the duties test from a 1999 GAO study of the white-collar FLSA exemption. The GAO study relied on information provided by DOL officials indicating that 257 of more than 900 job titles represented in the Current Population Survey would likely include exempt workers. The GAO study states that “for each of these 257 job titles, DOL officials provided us with one of four ranges of likelihood that workers would be covered by the white-collar exemptions: 90-100 percent, 50-90 percent, 10-50 percent, and 0-10 percent.” The job titles in the 1999 study are based on 1990 occupation classifications. The Census Bureau updated occupation classifications in 2000, 2010, and 2018, because of changes in the US workforce. The 1999 probability ranges were applied to 2010 Census occupations in the 2016 Final Rule and were re-applied to 2018 Census occupations in the 2023 NPRM, despite substantial changes in labor markets over the past 25 years. The NPRM applies dated assessments of probability ranges for white-collar exemptions instead of re-examining this issue to obtain a more accurate estimate of the impact of the NPRM.

Based on these assumed and outdated probability ranges, the DOL assumes that 15.4 million of the 43.8 million potentially impacted workers would not pass the duties test and concludes they would not be impacted by the proposal. The remaining 28.4 million potentially affected workers include about 24.9 million employees not affected because they earn more than $1,059 per week[5] and 3.4 million affected employees who earn between $684 (the current salary threshold) and $1,059 (the preliminary proposed threshold) per week.

Affected Employees in the South Census Region

Using the same methodology for the approximately 12 million full-time, non-hourly employees in the South Census region, where the salary threshold is determined, there are an estimated 1.4 million affected workers who earn between $684 and $1,059 per week and are expected to pass the duties test. If those workers are all reclassified to hourly employees, they will fall out of the distribution of workers that serve as the basis for the 35th percentile. By construction, all 1.4 million of those removed from the distribution were earning below the 35th percentile. The 35thpercentile of the resulting distribution after workers are reclassified is $1,154. For comparison, $1,154 is the 40thpercentile of the current distribution. Effectively, the DOL’s automatic update mechanism would increase the salary threshold by approximately 9.1% to the current 40th percentile within three years even if there was not ANY wage growth. If the recent inflation trend continues (13.6% over three years), the 9.1% increase due to the automatic update methodology would cause the threshold to reach $1,311 per week, or about $68,175 per year.

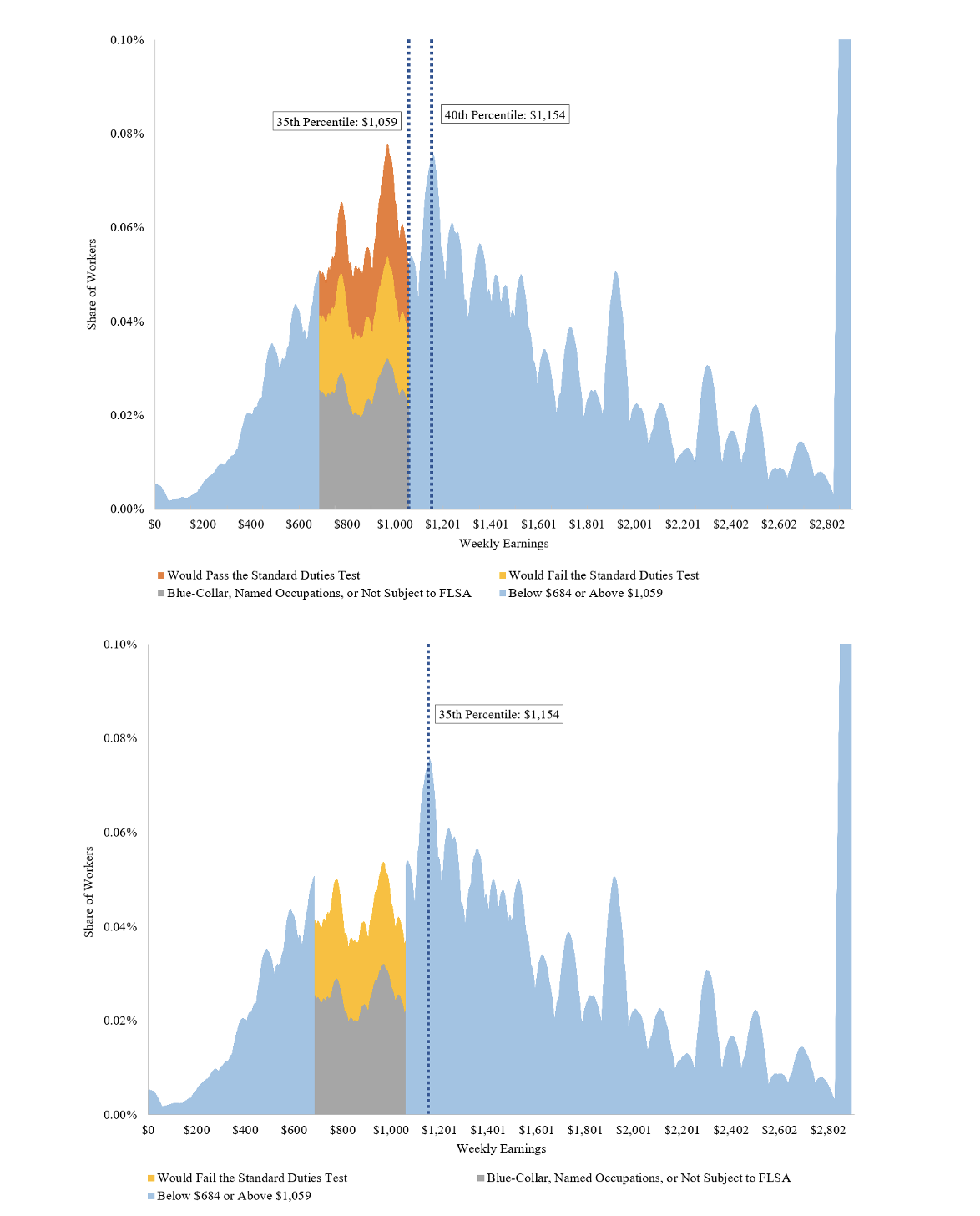

The analysis is provided in graphical form below. The top graph represents the current earnings distribution of full-time, non-hourly workers in the South Census region, which is the basis for the DOL’s proposed salary threshold. There is a dotted line at $1,059, which is the 35th percentile of the distribution and the DOL’s preliminary proposed threshold. Most of the distribution is shaded in blue, and those are the areas below the current threshold of $684 per week and above the preliminary proposed new threshold of $1,089 per week. The portion of the graph for those earning between $684 and $1,089 is composed of three groups of workers shaded in different colors. The group highlighted in grey represents the share of workers who are blue collar, in named occupations, or are not subject to the FLSA. The yellow section shows the share of workers the DOL’s methodology assumes would fail the duties test, and the orange section is the share of workers the DOL assumes would pass the duties test (which is the 1.4 million affected workers in the South Census region described above).

The bottom graph is the same distribution as the top graph, but we have removed the orange section representing the 1.4 million affected workers in the South Census region. Without those workers, the 35th percentile of the remaining workers is $1,154, and that is shown as a dotted line on the graph. A dotted line at the same weekly earnings ($1,154) has also been added to the top graph. There, weekly earnings of $1,154 are the 40th percentile. The removal of 1.4 million employees below the 35th percentile of the distribution pushes the 35th percentile of the remaining distribution up to the equivalent of the current 40th percentile without any wage inflation.

Additional Affected Employees

Some employers may increase employees’ salaries to comply with the new threshold instead of reclassifying them as hourly employees. As the DOL notes, the likelihood of such an increase is highest for those who are closest to the new threshold. Workers who receive such pay increases would remain in the pay distribution, but at a higher salary. If we assume the approximately 200,000 full-time non-hourly workers in the South who currently earn within 5% of the proposed threshold are not reclassified as hourly, but instead receive a pay increase to $1,059 per week, about 1.2 million full-time workers not paid by the hour in the South would be reclassified as hourly due to the NPRM.

As described above, the DOL’s estimate of affected employees excludes 15.4 million employees that their probabilistic methodology assumes would not pass the duties test. Of those, approximately 1.6 million are in the South Census region and earn between $684 and $1,059 per week. Given that the DOL’s analysis is based on a 1999 study using 1990 occupation codes, it is possible that it is not correctly identifying which or how many workers would pass the duties test. Alternatively, if the DOL’s methodology is correct, those employees are currently misclassified. Regardless, the duties test will no longer be relevant for these employees and they will not be eligible for the white collar exemption. It seems likely that an increase in the salary threshold will result in most (if not all) of those workers being reclassified as hourly employees.

Even if workers who would have passed the duties test and earn within 5% of the salary threshold (at least $1,008 per week) remain in the non-hourly pay distribution, there are 1.6 million workers who, based on the DOL’s methodology, would not pass the duties test and earn between $684 and $1,059 per week, and another 1.2 million who would pass the duties test and earn between $684 and $1,008 per week in the South region. If as many as 53% of these approximately 2.8 million workers are reclassified to hourly, the 35th percentile of the pay distribution after reclassification will effectively be the 40th percentile of the current pay distribution, and any increases due to wage growth would be in addition to that.

[1] NPRM, p. 2.

[2] NPRM, pp. 203.

[3] In 2022 the 35th percentile of the non-hourly pay distribution for full-time workers in the South was $55,000 per year and the 40thpercentile was $60,000, or 9.1% higher.

[4] NPRM, p. 36.

[5] The 0.2 million affected by the proposed HCE Compensation Threshold are counted here as not affected by the standard salary level change.

Experts

- Partner

- Partner